Our Mission

As we embrace decentralized technology to resist the abuses of traditional centralized power, we also give up the enforcement mechanisms that deal with wrongdoing. Without safeguards, this opens the door to a technocratic reality where hackers—armed with superior technical knowledge—become the new “centralized power,” stealing in broad daylight with little consequence. That undermines the very purpose of decentralization, and it’s a future we, as true believers in this movement, refuse to accept.

That’s why we created USD8.

Our mission is to restore the missing layer of enforcement in DeFi security. We will start with offering hack coverage to DeFi users, with ambitious plans for the future to ensure the decentralized dream is not hijacked by technocrats, but preserved as a system that empowers everyone.

Usd8

Usd8 is a stablecoin doubles as Defi protection, Usd8 users get coverage for supported Defi positions as well as stable yield.

There are three main use cases:

- For passive DeFi users who want their savings protected - Swap your stablecoins for Usd8 and deposit into Protected Savings to earn yield while being covered.

- For advanced DeFi users actively managing their own yield strategies - Hold Usd8 (or Usd8 LSTs) and freely use any Covered DeFi Protocols, now all your positions are protected by the Cover Pool.

- For users seeking high yields and with high risk appetite - Deposit assets into the high-yield Cover Pool and share protocol revenue. However, remember these assets may be deployed to cover losses from Covered DeFi Protocols.

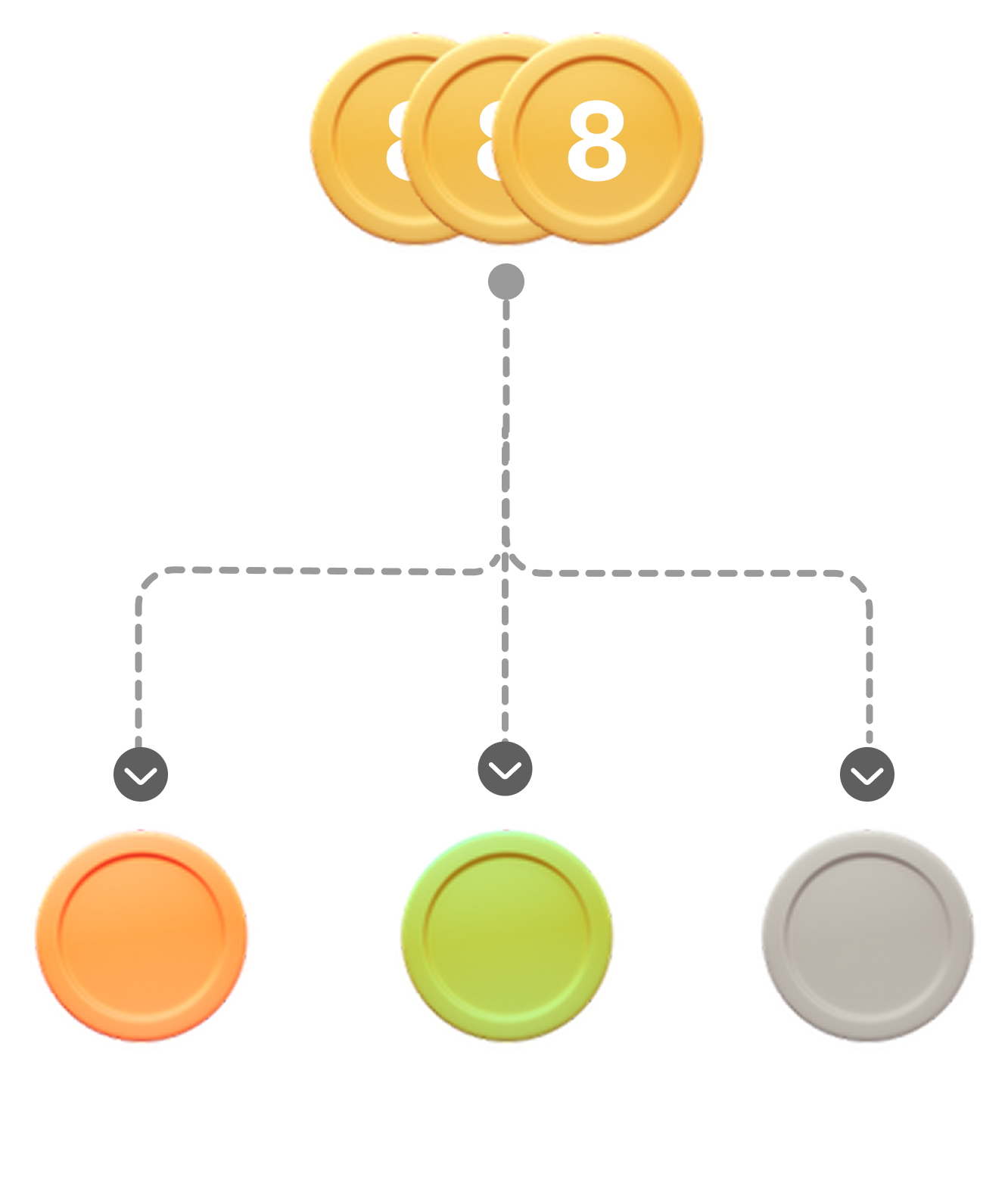

Multi-Collateral

USD8 is backed by a carefully selected basket of stablecoins, reducing the protocol’s exposure to any single asset and making USD8 more resilient to de-pegging events.

- When launched, new USD8 will be minted and redeemed in the same proportions as the collaterals in the basket.

- Each collateral’s weight in the basket may be adjusted based on its ongoing risk profile.

We are currently finalizing the collateral basket. Details will be announced soon.

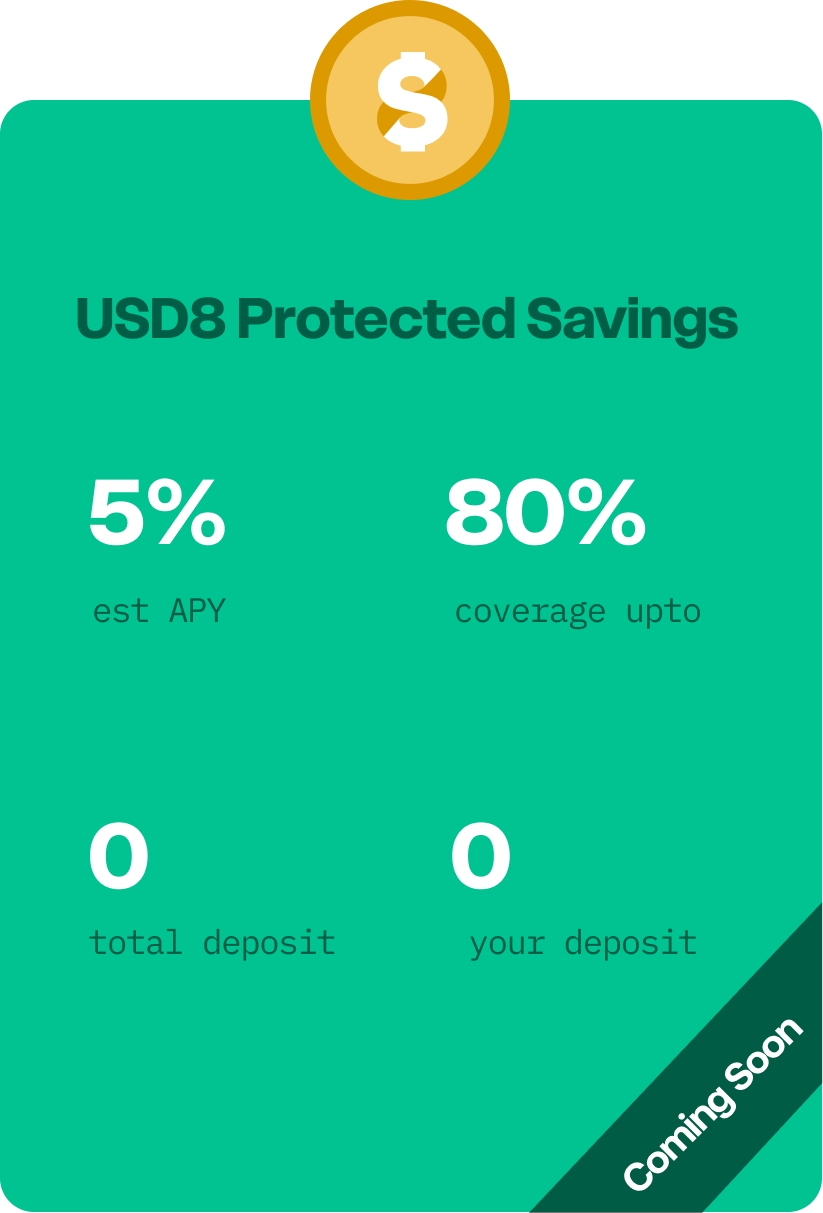

Protected Savings

USD8 Protected Savings is a yield vault designed for passive DeFi users who want simple, deposit-and-forget yield with built-in protection.

Managed by USD8, this vault is covered by the Cover Pool for up to 80% of its value, subject to the pool’s limit.

Depositors receive yield-bearing sUSD8, which can be used to claim coverage from the Cover Pool, permissionlessly, at any time, up to 80% of the sUsd8 value, capped by the Cover Pool balance.

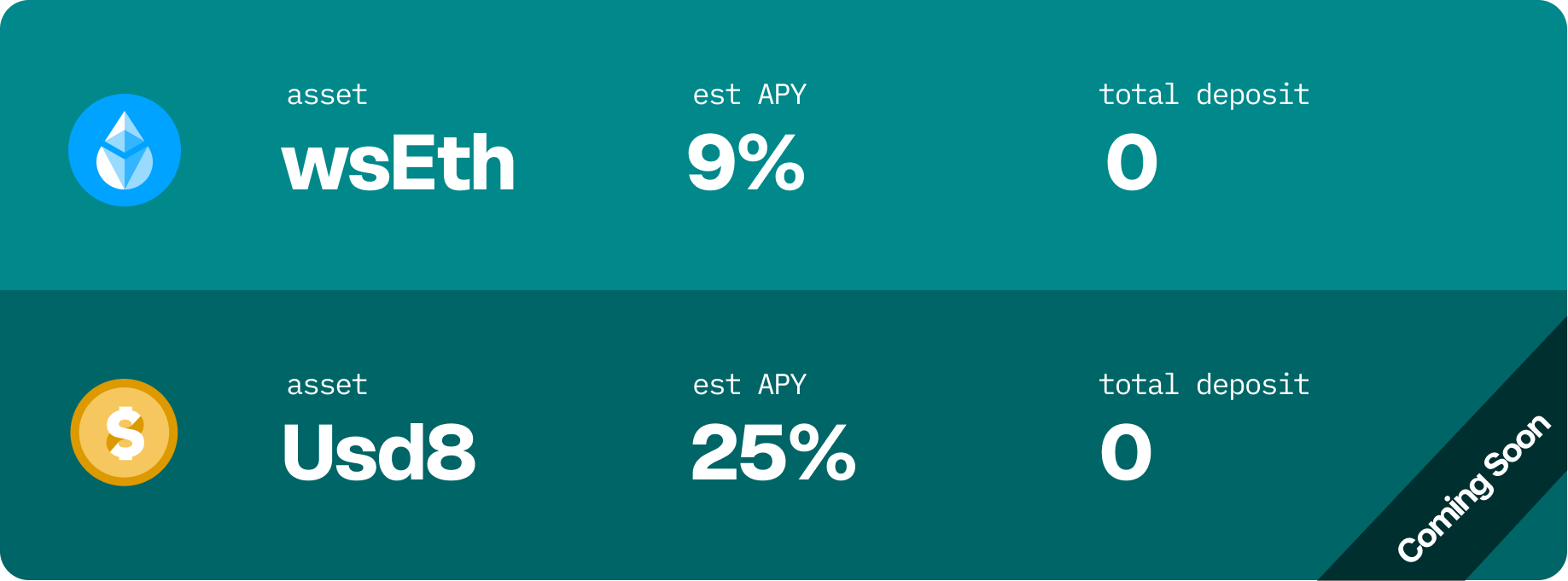

Cover Pool

The Cover Pool is a high yield high risk vault consists of multiple assets, the yield comes from protocol revenue. Anyone can deposit into the pool at any time; however, withdrawals are subject to a 14-day cooldown period.

Assets in the Cover Pool might be deployed to cover any losses from protected Defi protocols.

Depositors should be aware of the risk associated before depositing.

Covered DeFi Protocols

Usd8, together with our security partners, independently vets and selects DeFi protocols that demonstrate the strongest security practices. Coverage is offered on a per-LP-token basis, depending on our security assessment, and is limited to a percentage of potential losses, capped by the Cover Pool balance.

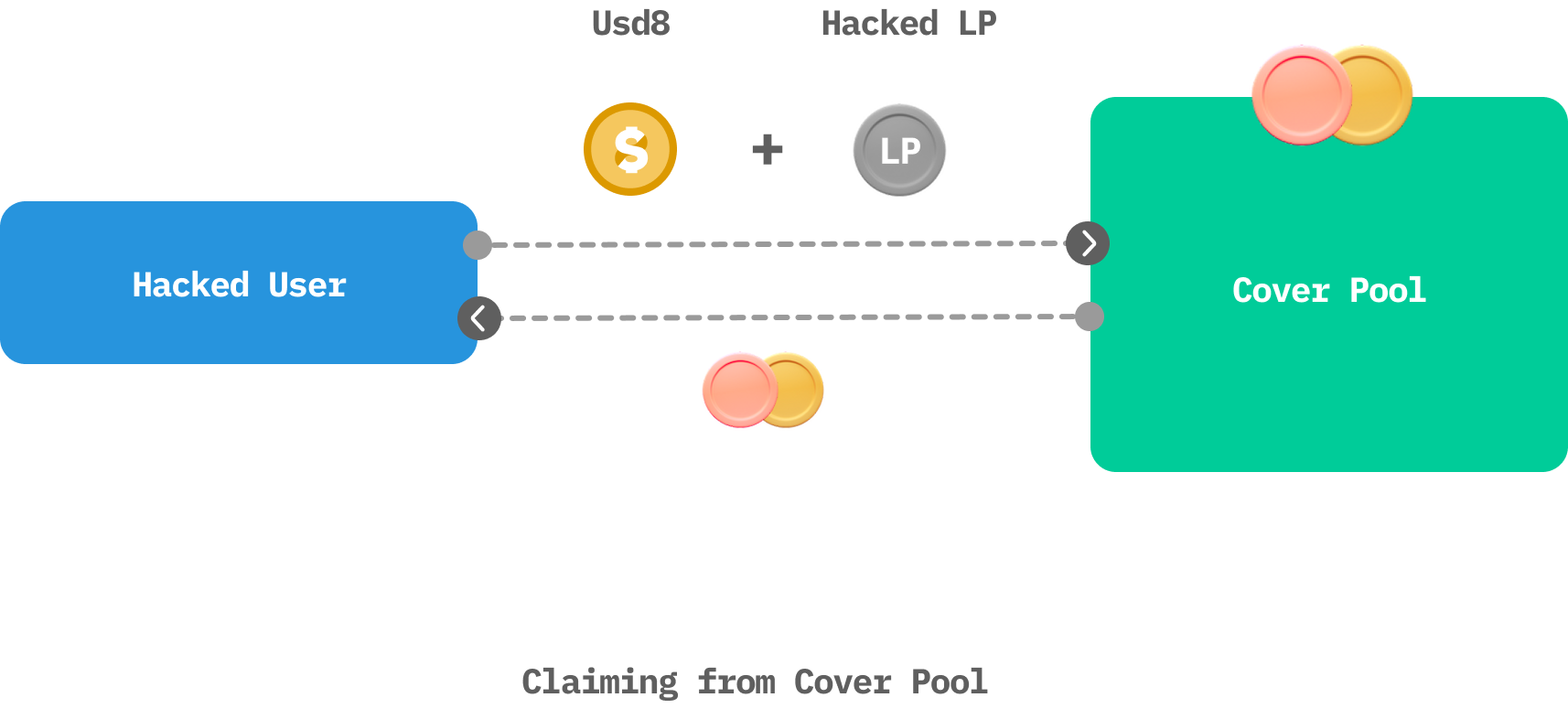

Once coverage is offered, the Cover Pool will accept the specified LP token for claims at any time, permissionlessly. Claimants receive a proportional mix of assets matching the Cover Pool’s composition.

Claiming

- To initiate a claim, the user provides the protected LP token and temporarily locks some Usd8. The more Usd8 locked, the greater the weight of the claim. (locking Usd8 optional if LP token is already a Usd8 LST).

- The claim then enters a 10-day waiting period, during which other users may also join. After this time, this LP token will be removed from covered list, further claims will not be accepted.

- Users can finalize their reimbursement after the 10 days waiting period, reimbursement amount depends on the total claims, total locked Usd8 and Cover Pool balance at the time. The payout will be in the exact asset types and composition of the Cover Pool.

- 60 days after claiming, the locked Usd8 will be unlocked and can be withdrawn from the Cover Pool.

If the Cover Pool cannot fully cover all claims, assets are distributed based on the amount of Usd8 each user locked and the value of their LP tokens.

After a claim, the protected LP tokens forfeited by claimers becomes the property of the Cover Pool LPs, which can be claimed when LP withdraws from the cover pool.

Claim Cooldown

Newly received Usd8 are subject to a 30-day cooldown for claiming lock, except from recognized Defi contract addresses (e.g. Usd8 LSTs and LP positions). This prevents users from purchasing Usd8 on the spot when claiming while still allow holders to yield with Usd8 while enjoying the protection.

FAQs

💭 Can I just buy Usd8 and use it for claiming whenever I need it?

No. Usd8 comes with a 30-day cooldown after you receive them. During this period, they cannot be used for claims.

Except if they are from a known Defi yield contract you deposited in, this allows Usd8 owners to yield with Usd8 and still enjoy the protection.

💭 How safe is the Protected Savings vault?

It is one of the safest savings vaults because it comes with an 80% coverage. This means you can always claim up to 80% of your position value from the Cover Pool if something goes wrong.

On top of that, you still earn competitive the yield.

💭 How safe is the Cover Pool?

Assets deposited in the Cover Pool are used to cover hacking losses from Covered Protocols. This makes it riskier than the Protected Savings vault, which is why it offers a higher APY.

Our security experts independently vet and audit every protocol before offering coverage. Claims are not expected to occur often, but there is always a possibility.

💭 So all my positions in Covered DeFi Protocols are protected?

Yes. As long as you hold Usd8, you can lock them to claim for any covered defi positions. Locking Usd8 is optional if the position already involves Usd8 e.g. an Usd8 LTS, AMM LP token of an Usd8 pool.

💭 Do I need to hold Usd8 at all times to enjoy coverage?

No. While holding Usd8 certainly gives you coverage, you can also deposit Usd8 into recognized DeFi protocols for yield. When you need to make a claim, simply withdraw your Usd8 from these protocols. Usd8 coming from recognized DeFi protocols are not subject to the 30-day claim cooldown.

💭 Do I forfeit my covered LP token when claiming from the Cover Pool?

Yes. To claim from the Cover Pool, you must provide:

- A covered LP token

- Lock some Usd8 for 30 days (optional if the LP token is already a Usd8 position)

The covered LP tokens are transferred to Cover Pool liquidity providers.

💭 Will I always get 80% of my money back for a defi protocol with 80% coverage?

Not necessarily. The actual reimbursed amount depends on:

- How many other users are claiming using this LP token and their position sizes

- How much Usd8 each claimant locks

- The balance of the Cover Pool

In practice, the more Usd8 you lock, the higher your claim weight. The max reimbursement amount is 80% your LP value, but it is also possible you might get less than that.

💭 How do you prevent fraudulent claims?

Usd8 only covers up to 80% of any position at max. Unless the LP token’s value drops below 80%, it is not financially rational to file a false claim to the Cover Pool.

💭 How does Usd8 make money?

Like most stablecoins, Usd8 generates revenue from collateral yield.

- A portion of this yield is distributed to Usd8 Savings depositors.

- The remaining yield becomes Usd8’s revenue, which is primarily distributed to Cover Pool depositors.

💭 Who is behind Usd8?

Usd8 was founded by an OpenZeppelin auditor and security researcher with over 5 years of experience, specializing in DeFi protocols and Ethereum Layer-2 solutions.

We are passionate about DeFi security and dedicated to building solutions that make the on-chain environment safer for everyone.

Contact

We are at the early stage of this project, collaborations and contributions welcome.

- telegram https://t.me/+e84i2oYk1ao1MTk1